If you are a television producer, chances are you are nervous come November, as it very well maybe the month that decides the status of your employment.

Every year, October through November is one of Nielsen Rating’s classic "sweep" periods. During this time Nielsen both collects data through its set-top boxes and mails small diaries to various samples of people in various television markets of the United States to record their viewing history throughout a seven-day period. All of this data is then collected, sorted through, and aggregated into data, which can then be used to draw conclusions about the viewing audience.

The November Sweep is considered the most important due to the high television viewing during the winter months and proximity to the traditional Aug-Sept premiere sates coming from new TV shows. This period of data is often the most critical for television producers, network executives, and content buyers to judge the success of current and potential future TV shows.

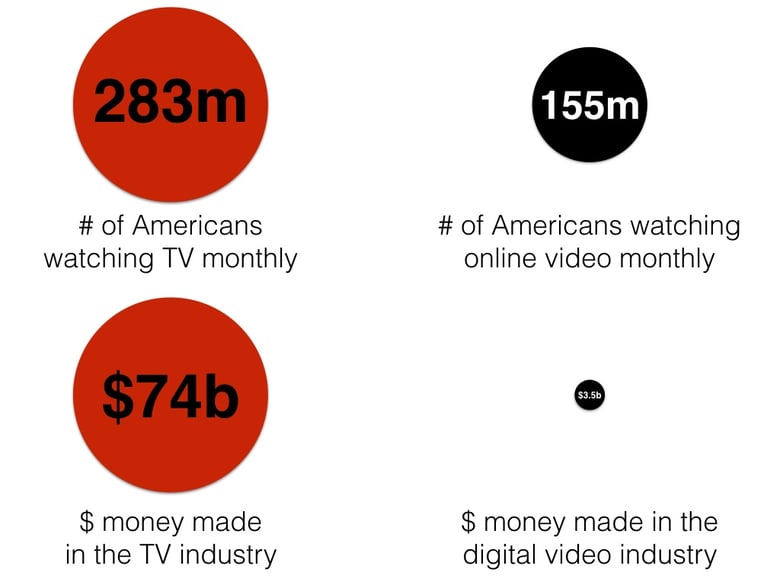

Although there are many ways to watch television these days and thus many ways to advertise, the most profitable - and thus the most important - way for networks is still the time-honored system of selling adverts on first-run airings of programs. The Nielsen Rating is the industry standard on how many people are watching which show and is often considered the most important data point in television. It informs advertisers of the value of that 30-second spot of commercial time they are considering buying. Simply put: # of viewers = price networks can charge for adverting time.

Television is still the largest way people consume media and information and is likely to remain so for many years. With this in mind, it is important to understand the way ratings work.

How Nielsen Rating System Works

The Nielsen rating is presented in points where one point represents 1% of the potential viewing public. Of course Nielsen cannot monitor every one of the 160 million US households with television, so they use statistical sampling instead.

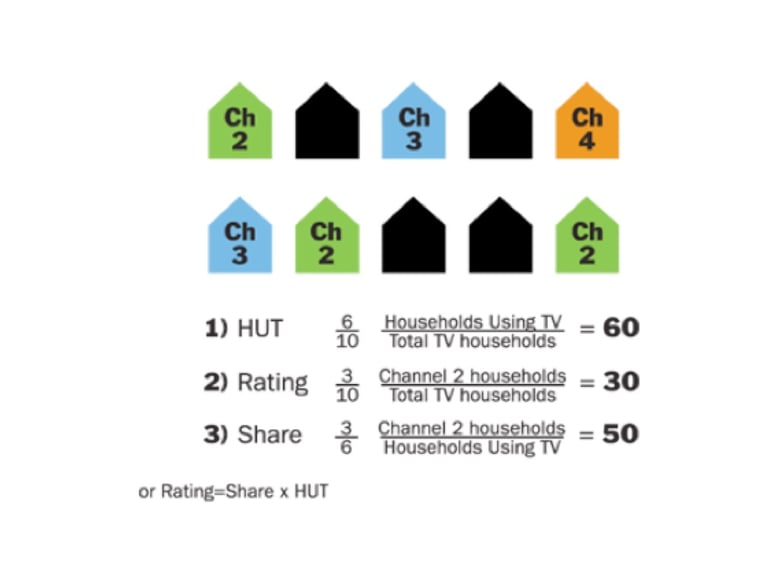

For example, if there are only 10 households with televisions in our pretend universe and only two are tuned into your show (or your channel at a particular time), then your rating is 2% or 2.0 on the Nielsen scale. Sometimes Nielsen will also provide the "share" of households watching your show. The share is directed from the number of households watching your show our of household currently watching tv at that time. If only 6 households are watching tv out of the 10 who have the ability to watch tv, and 3 of those 10 are watching your show, then your share is 50% or 50.0. These numbers are some of the most important for advertisers to know when buying air time.

For example, if there are only 10 households with televisions in our pretend universe and only two are tuned into your show (or your channel at a particular time), then your rating is 2% or 2.0 on the Nielsen scale. Sometimes Nielsen will also provide the "share" of households watching your show. The share is directed from the number of households watching your show our of household currently watching tv at that time. If only 6 households are watching tv out of the 10 who have the ability to watch tv, and 3 of those 10 are watching your show, then your share is 50% or 50.0. These numbers are some of the most important for advertisers to know when buying air time.

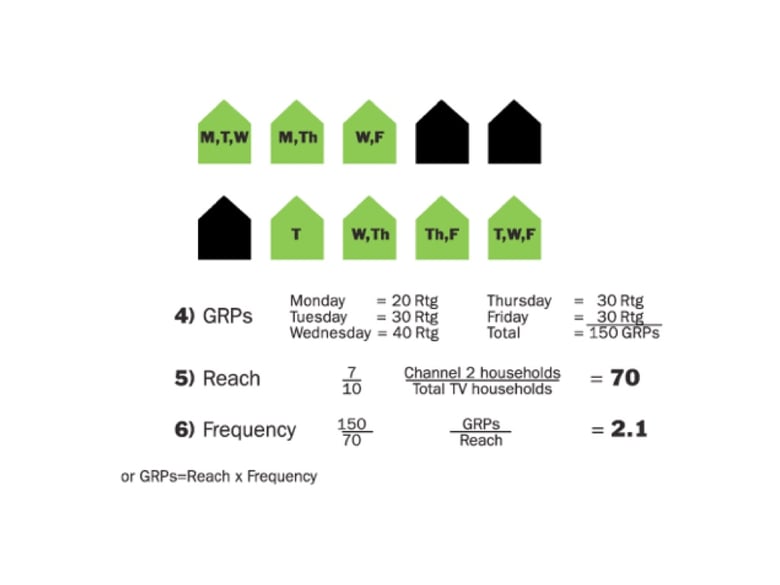

The most important, however, is of course the number of people who view their advertisement specifically. These are the gross ratings points (GRPs) or how many times an advert was viewed, the reach or how many unique households viewed the advert, and the frequency or how many times a unique person on average viewed the advert.

For example, if a certain ad was viewed 15 times across 7 households, the GRP would be 150 (10 points for each viewing), the reach would be 70 (or 7/10 houses viewed the ad), and a frequency of 2.1 (the GRP divided by the reach, or 150/70). The larger the reach and the frequency make the ad-slot time more valuable to advertisers. For a network executive, increasing these numbers is of the upmost importance.

Problems with the Nielsen System

There are multiple problems with the Nielsen system on how the company measures television ratings. A few include possible response bias in Nielsen families, the fact that the ratings sample is not truly random, and the under representation of minorities included in these samples. The most important argument these days against Nielsen these days comes with the raise of technology and the disruption of traditional television viewing.

Cable television subscribers have been in decline for years. In the last five years alone about 5 million cable subscribers have unsubscribed. Telecom companies like Verizon and AT&T have been eating away at cable television market share for years. Cable now is well below 50% market share. People have shifted from watching television on their television to now watching online and on their mobile devices. As these trends away from traditional television continue, Nielsen ratings arguably become more and more inaccurate and irrelevant.

The argument is simply measuring television viewers is a very inaccurate way to judge how many people are watching and loving your show when there are near countless avenues online to watch as well: Netflix, Hulu, iTunes, and On-Demand just to name a few. When these are not properly measure, shows that so many people watch will be unjustly canceled. Why should Nielsen, a flawed system, be allowed to deal out such a fate?

Part of the reason why Nielsen remains so important is that all television executives have agreed to pretend it works, even if they know better at heart. NBC’s Alan Wurtzel said:

“Ratings are a currency, so they’re just as important now as they were ten years ago. It’s how we get paid. But in this new media environment, do these numbers reflect accurately how many people are viewing this content? The answer is no. Are we happy with the way we’re following technology and being able to measure it? No. We’re way behind. On the other hand, are Nielsen ratings important and critical to the industry and as important to the industry as they even were? Absolutely, when you consider that if we didn’t have them, we wouldn’t get paid.”

Nielsen ratings are so important because they still decide the bulk of what airs and who gets paid. Although viewership is changing, television is still the dominant form of media by far. American watch 34 hours a week of broadcast cable. This dominance means selling airtime to advertisers is still the main way networks make money. Which in turn means that Nielsen ratings are still the most important measurement in the game.

Advertisers, however, do not just care about raw numbers, they also care about demographics. Nielsen’s (in)famous “People-meter” set top TV box is now nearing its 30th birthday. This technology not only measures what people watch and when, but also collects data about who in the household is watching what and when. Sometimes, each member of the household will be given a small remote to indicate when they are watching TV. A profile of each person in the household is saved and this data is used to inform which demographics are watching which shows. Every tv addict at some point has longed to be one of these “Nielsen Families,” and as of 2012 there are around 20,000 of them in the US alone. These demographic numbers are usually just as important, if not more so, than the standalone viewer numbers. The most prized demographic being people under the age of 35.

The Importance of the Young Demographic (Millennials!)

As an adult, it is easier to resent young people more everyday, but as a television executive who wishes to stay employed, you must love them. Creating content that people under the age of 35 enjoy and watch is a must to the success of a media company. Raising ratings amongst this group is key to attracting advisers; and these days, with Millennials being picker and more restless than ever, the task can be very difficult.

Advertisers not only want to reach large audiences, they want to reach audiences that they feel will be more inclined to buy their product. They care about demographics. Different products have an interest in reaching different target markets and demographics. The most prized demographic for most products, however, is the 18-34 year old group. These young people are generally viewed by advertisers as less loyal to established brands, more susceptible to advertising, willing to work and spend money, and, of course, hip to cool new trends. Capturing this demographic is viewed as critical to creating life-long customers.

The value of this demographic is obvious to television executives and producers too. Executives find they can charge more per ad if they have a high percentage of young viewers, even if their overall viewership is low. For example, during the 2007-08 season ABC was able to charge $419,000 per 30-second spots for its show Grey’s Anatomy, whereas CBS could only charge $248,000 per spot for CSI, even though CSI had almost 5 million more viewers. This is an vast difference that could make all the fuss over attracting Millennials worth it when pay day comes. It might be wise for the average television exec to make a larger investment in knowing what Meredith and Derrick (sp?) are up to next. (No spoilers!)

With all this economic power, Millennials are driving the largest change in television since its creation: movement away from the traditional model to digital.

The Decline of Traditional Television

According to studies, Millennials watch the fewest hours of television compared to their parents and grandparents. This data seems counter intuitive, however, with Millennials well-known for binge-watching entire season in one sitting. The truth, as Jason Potteiger, stated in his essay “TVs Missed Opportunity,” “Because of the Internet, people are watching more TV, not less.” Having the ability to watch whatever, whenever, and wherever has driven the decline of traditional televisions. This has made them picky; Millennial viewership of certain shows is also heavily fragmented, more than any older demographic. With so many options, fewer Millennials watch the top rated shows for their demographic. Their tech savvy frees them from the constraints of cable; only 43% of Millennials believe they have a cable subscription in five years, compared to 61% who believe they will have a Netflix or Hulu subscription. That is just for entertainment television - when it comes to accessing the news only 34% of Millennials say they will turn to the TV (compared to the internet).

Millennial habits have had an effect on the whole industry. Traditional television viewership has been in decline for years. The tech revolution has disrupted the traditional revenue generating models of cable companies in notable ways. Ratings overall are down for both cable and network channels. Cable television subscribers have been in decline for years. In the last five years alone about 5 million cable subscribers have unsubscribed. Cable now is well below 50% of the market. Cable is also having difficulty retaining customers, in part because of awful customer service and increasing prices. Speaking of prices, cable has slowly raised prices over the years to make up for the revenue loss from lost subscribers. This creates a vicious cycle of raising prices and cancelling subscribers. And perhaps most troubling of all, the percentage of households with television in America is declining.

People have shifted from watching television on their television to now watching online and on their mobile devices. These trends have been traveling in the opposite direction of cable. People are increasingly spending more time online and on mobile devices. Mobile video is experiencing near exponential growth with traffic expected to double over the next two years. Over 40% of Youtube streams come from mobile and that number is growing. As mobile is growing, so is the market share of telecom providers like Verizon and AT&T, which have been eating away at cable market share for years. Mobile viewing also allows for the possibility to take advantage of free wifi, allowing for the consumer to go broadband free as well as cable free.

Ad spending is following suit, with digital adverts having the most room to grow. As this money follows from print and television to digital, it increases the likelihood of Internet companies to create more worthwhile online television and new forms of entertainment. Additionally, as technology changes Nielsen has begun to change to keep up too. In 2007, Nielsen began measuring DVR viewing. Recently, the company also announced its new “Total Up” campaign to include all online viewership as well. As the Nielsen ratings become more inclusive and accurate, it will inform networks about these shits and allow for the further proliferation of Internet television.

So not to worry, young ones! As your love of Internet media grows advertising, investment, and new business models will follow. Indeed it has started already!